PPA reduces risks for renewable asset owners

Wind and solar power plant owners strive to maximise revenue and to efficiently manage their risks in an ever-changing volatile power market. With over 10 years of power trading experience, Priogen can cover your market risks and optimise your revenue with a Power Purchase Agreement (PPA).

Covering market risks and increasing revenue

As part of a financial closure, most asset owners opt for a PPA because these agreements cover risks as forecasting (balance) and shaping (i.e. profile).

The forecasting risk is the risk of losing revenue as the wind or solar plant is not producing according to the power forecast. Programme responsible parties are obliged to make an (hourly) power forecast for their wind and solar parks for the next day. Uncertainties and changes in weather forecasts are the main reason of forecasting risk for asset owners. Especially when multiple asset owners make the same forecasting mistake even the smallest weather changes can cause extreme imbalance prices.

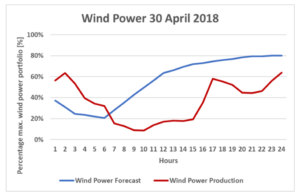

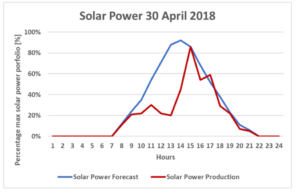

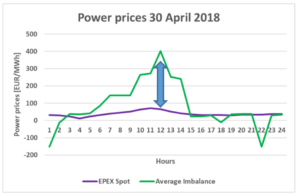

A good example of very high imbalance costs due to weather conditions in the Dutch power market was 30 April 2018. During this day, high wind and solar production was forecasted by many market participants but both renewables were producing lower than expected most of the day (see graphs).

Since of the meteorological changes during the day, the Netherlands was short on renewables and imbalance prices spiked up to 400 EUR/MWh (see power prices graph). Needless to say, 30 April 2018 was an expensive day for both wind and solar asset managers. More information about this day can be found in this national news article https://nos.nl/artikel/2229787-netbeheerder-moest-groot-inkopen-om-stroomtekort-op-te-vangen.html. As of more renewables are expected to be connected to the grid, accuracy in global weather forecasts and forecasting risk takers are becoming more crucial in the coming decades.

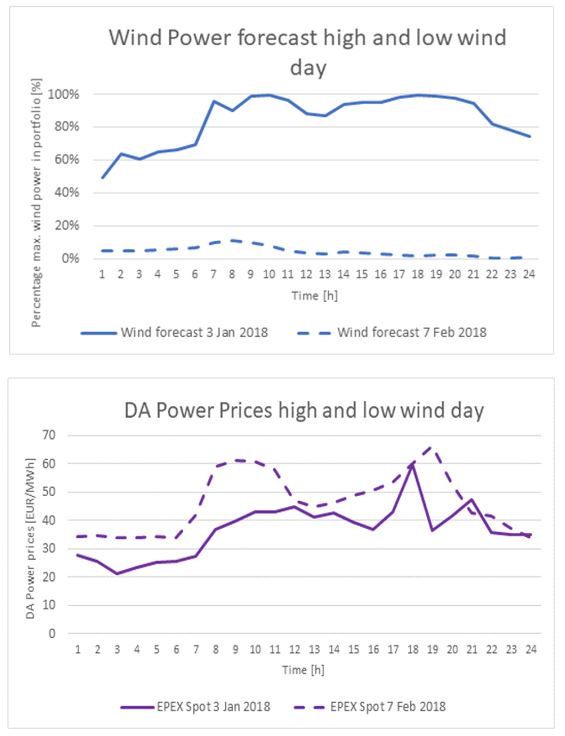

The Effect of Shaping

The effect of shaping (i.e. profile) is another risk that Priogen can take over from asset owners in a PPA. Due to dependency on the weather, the wind and solar parks do not produce baseload power but deliver an intermittent pattern. Therefore, the highest production is not always during the highest power prices (see an example for Dutch wind in the graph). Due to the installation of more wind and solar parks the effect of shaping is only expected to increase, also referred to as the cannibalization effect. A PPA including the shaping risk will cover this effect by paying out a price closer to the monthly baseload power prices.

More information on PPAs

For more information on PPAs and trading (as risk values, historical shape factors and including the effects on subsidy-free markets), please find a prestation here.

In a PPA forecasting (and shaping), risks are taken care of by Priogen and the asset owner has a more stable income from the contracted park(s).

Why Priogen?

PPAs via Priogen brings several benefits for current and future investments:

- Priogen has over 10 years trading experience in numerous power and gas markets in Europe and the USA.

- We have our own global weather model and inhouse meteorologists to have the best and latest weather insights.

- PPAs provide asset owners with stable income, de-risk their exposure to the power market and can contribute to financial close. Priogen has experience in all these three components.

- We are successfully reducing risks for over 50 wind and solar assets in Germany and The Netherlands and we are growing to other countries soon.

- Priogen makes tailor made PPAs: we know what you need and listen to what you want (and what don’t want).

- Both individual parks as framework agreements are possible.

- Contract duration ranging from 1 up to 15 years ahead.

- PPAs can start any day of the year.

- Complex projects as batteries attached to solar parks or cable pooling constructions are not obstacle for us and can be included in the PPA.

- We can help brainstorming in an early process of the park.

Additional services, as cash flow predictions, are possible.